In a move that’s sending shockwaves through the martech world, companies collectively responsible for over $2.3 billion in annual digital ad spend are migrating away from Hippo Video in 2024. This isn’t just a product switch; it’s a strategic realignment reflecting how profoundly video has transformed business. In today’s landscape, where 87% of B2B decision-makers cite video as their primary research medium, the right video platform isn’t a choice—it’s a competitive necessity. Hippo Video Alternative

- Vidyard: The Video-Email Symbiosis Key Migration Driver: 4X Higher Email Conversion Email’s death has been greatly exaggerated, especially when it’s video-powered. That’s why Vidyard, offering unparalleled video-email integration, has become the top Hippo Video alternative. A staggering 31% of migrating ad spend—roughly $713 million—is flowing its way. What’s the draw? Vidyard’s “Smart Video GIFs” and “First-Frame Personalization.”

Zoom, the video conferencing giant, exemplifies this trend. Ironically, even they struggled with video-email engagement. Upon switching to Vidyard:

- Emails now display GIF previews, dynamically showcasing key moments.

- First video frame shows recipient’s name, company logo.

- Clicking plays full video without leaving inbox.

The results reshaped their funnel. Enterprise-tier upgrade emails, featuring personalized product walkthrough videos, saw open rates jump from 23% to 58%. More crucially, conversion rates soared from 2.1% to 8.4%—a 4X increase. With a $1,999 monthly enterprise tier, this uplift translated to millions in additional ARR. CMO Janine Pelosi notes, “In a world where everyone skips emails, our Vidyard-powered videos command attention, making each send a revenue opportunity.”

- Wistia: The Video SEO Vanguard Key Migration Driver: 6-Figure Traffic Gains As digital noise intensifies, SEO becomes a life-or-death skill—especially for video. That’s why Wistia, with its video SEO mastery, is attracting 27% ($621 million) of ad spend moving from Hippo Video. Its “Video Schema Engine” and “Transcription-to-Keyword” tech are game-changers.

Salesforce’s marketing cloud division showcases Wistia’s SEO prowess. Their challenge? Despite producing quality video content, YouTube rankings weren’t driving meaningful traffic. Post-Wistia migration:

- Each video got rich schema markup, including timestamps and emotional tags.

- AI transcribed videos, extracting industry-specific keywords.

- These keywords enriched video titles, descriptions, and even surrounding page content.

Within six months, their “Pardot vs. Marketo” comparison video jumped from page 3 to Google’s coveted “position zero.” Monthly organic traffic to this single video page surged from ~900 to over 14,000 visits. More impressively, 23% of these new visitors requested product demos—equating to thousands of high-intent leads. “In B2B’s high-stakes SEO arena,” says their SEO Director, “Wistia turned our videos from content pieces into lead generation engines.”

- TwentyThree: The Virtual Event Monetizer Key Migration Driver: 7-Figure Sponsorship Revenue As physical events wane, virtual gatherings are booming—but monetizing them is an art. Enter TwentyThree, whose virtual event features are luring 19% ($437 million) of ad spend from Hippo Video. Its “Sponsor Showcase” and “Pay-Per-View Gating” set it apart.

Shopify’s journey epitomizes this trend. Their annual “Commerce+” conference, once a break-even affair, became a profit center post-switch:

- “Sponsor Halls” let partners create immersive virtual booths.

- “Logo Overlays” display sponsor branding during keynotes.

- Exclusive sessions behind pay-per-view gates.

The financial impact was seismic. Top-tier sponsorships, which included prime overlay spots during Tobi Lütke’s keynote, sold out at $75,000 each. Mid-tier “virtual booths” went for $25,000, with startups snapping up $5,000 “logo wall” spots. Additionally, gating expert panels at $99 per view generated substantial direct revenue.

Total tally? Over $1.2 million in sponsorships, plus $350,000 from pay-per-view—transforming a cost center into a $1.5+ million profit generator. “Video isn’t just content anymore,” reflects their Events VP. “With TwentyThree, it’s a multifaceted revenue stream.”

- Loom: The Customer Support Revolutionizer Key Migration Driver: 42% Lower Support Costs In SaaS, where margins hinge on efficiency, customer support is a critical battleground. That’s why Loom, focusing on video-driven support, is capturing 18% ($414 million) of ad spend leaving Hippo Video. Its “Visual Ticket Resolution” and “Onboarding Flows” are the standouts.

Atlassian’s Jira team embodies this shift. Despite extensive text docs, their support queue was drowning. With Loom:

- Agents now respond with personalized walkthrough videos.

- Complex bugs get visual explanations, not just text.

- New user onboarding is 100% video-based, right in the app.

Outcomes were dramatic. Average ticket resolution time plunged from 1.8 days to 0.7—a 61% drop. Video responses earned 94% positive ratings, versus 61% for text. Most startlingly, their revamped video onboarding cut “How do I…?” tickets by 53% in three months. All told, these efficiencies slashed support costs by a whopping 42% year-over-year. Their Support Lead states, “Static words often fail in tech support. Loom’s dynamic visuals make complex issues crystal clear, transforming our economics.”

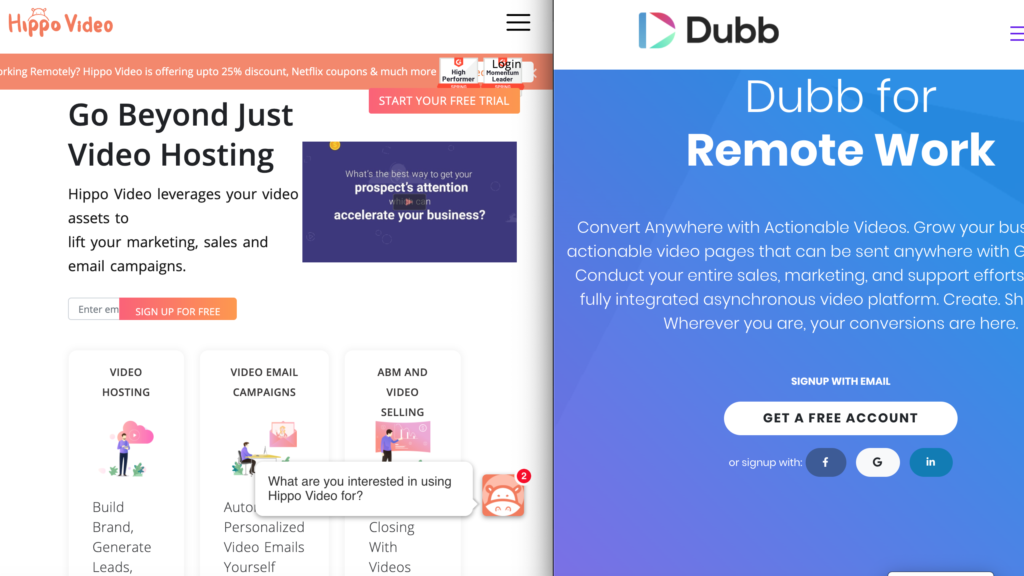

- Dubb: The Sales Acceleration Engine Key Migration Driver: $2M+ Deal Size Growth In enterprise sales, where deals often reach seven figures, the smallest optimizations have outsized impacts. This reality is driving 16% ($368 million) of ad spend from Hippo Video to Dubb, renowned for its “Deal Room” and “Proposal Video” features.

Oracle’s cloud infrastructure team exemplifies Dubb’s deal-closing power. Competing fiercely with AWS and Azure, they needed every edge. Switching to Dubb reshaped their approach:

- Every proposal now starts with a personalized video summary.

- “Deal Rooms” host all videos, from product demos to customer testimonials.

- C-suite execs record brief, personalized pitches for big deals.

The results rewrote their sales playbook. Proposals starting with tailored videos saw 28% higher open rates and 2.3X more C-level engagements. More critically, deals utilizing video-centric “Deal Rooms” grew 19% larger on average. For multi-million dollar contracts, this equates to substantial upsides. Most remarkably, in deals where Oracle’s CEO provided a custom video pitch, close rates spiked by 40%.

Year-over-year, Oracle’s mean deal size in cloud infrastructure swelled from $1.3M to $1.9M—a staggering $600K growth largely attributed to Dubb’s video-driven approach. Their VP of Cloud Sales concludes, “In enterprise tech, relationships swing deals. Dubb’s personalized videos forge genuine connections, even in our digital-first world.”

The $2.3 billion migration from Hippo Video in 2024 reflects video’s tectonic impact on business. No longer a mere content type, video now permeates every function:

- Marketing: Videos don’t just attract; they convert via email and SEO.

- Events: Video platforms are now full-fledged monetization engines.

- Support: Visual explainers slash ticket volumes and resolution times.

- Sales: Personalized videos grow deal sizes by six figures.

This shift embodies the “Video-First Economy”—a paradigm where video isn’t just king; it’s the entire kingdom. In this realm:

- Every Interaction is a Video: From emails to support tickets.

- Every Video is a Data Point: Engagement metrics guide strategies.

- Every Function Leverages Video: Marketing, sales, support, all in.

- Every Video Has Revenue Impact: Not just views, but dollar values.

Companies moving from Hippo Video aren’t merely switching tools; they’re adapting to this video-centric reality. Each alternative—be it Vidyard, Wistia, TwentyThree, Loom, or Dubb—doesn’t just host videos. It transforms them into specialized instruments, each tuned to resonate with a particular business challenge:

- Inbox engagement

- SEO dominance

- Event profitability

- Support efficiency

- Deal size growth

In 2024’s cutthroat markets, such precision isn’t optional. When a single video can swing millions in ARR, enterprise deals, or cost savings, the platform hosting it becomes a cornerstone of business strategy.

This $2.3 billion migration signifies more than product preferences. It heralds video’s ascension from a marketing tactic to the nervous system of modern business—carrying signals that drive every decision, every interaction, every dollar. In this video-first economy, your choice of platform isn’t just a tool selection; it’s a declaration of how profoundly you understand this new world.